LESSON 7: NORMAL DUE DILIGENCE MEASURES

The analysis of the client begins with the identification and verification of his identity through reliable documents that allow him to be known before starting business relationships.

Obliged subjects may not maintain any business relationship with a person (natural or legal) who is not correctly identified. Likewise, the obliged subjects must formally identify all those persons involved in the operation (end customer, guarantor, donor, representative of the company, etc.).

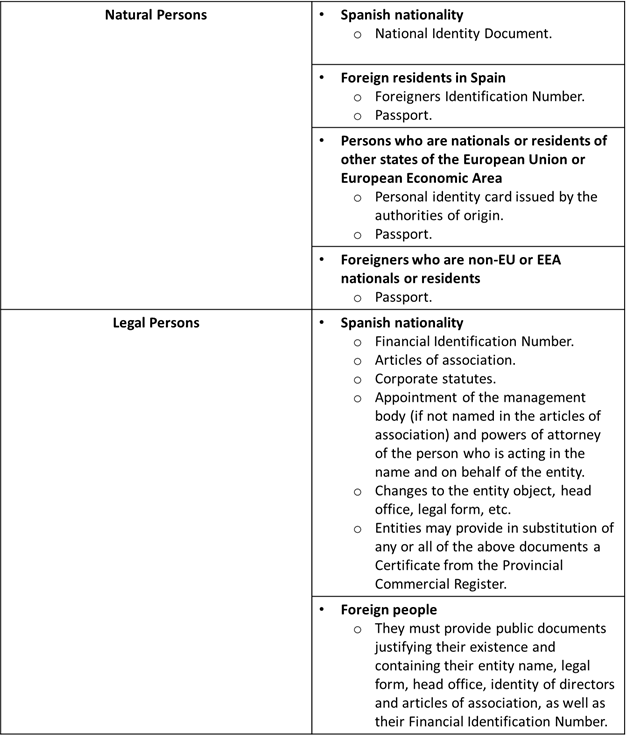

- Reliable documents for formal identification purposes.

Article 6 of tthe Royal Decree lists the documents considered reliable for the purpose of formally identifying the clients and any other person who may intervene in the operation.

The documents must be in force at the time of submission. In the case of legal persons, the validity of the data must be accredited by a responsible statement from the client.

All documents must include a photograph of the holder.

BENEFICIAL OWNER

Law 10/2010 establishes that the obliged subjects must identify the beneficial owner by adopting the appropriate measures in order to know their identity. For these purposes, the beneficial owner is understood to be “the natural person or persons on whose behalf it is intended to establish a business relationship or intervene in an operation”.

These verification measures must be adopted prior to the establishment of the business relationship or the execution of the operation, as well as, as soon as there is evidence or certainty that the clients are not acting on their own behalf.

The refusal to identify the real owner or owners of the operation must lead to the end of the business relationship or the non-execution of the operation.

Beneficial ownership of legal persons

Law 10/2010 requires identifying the beneficial owners of the legal entity and verifying their identity prior to the establishment of business relationships or the execution of any operation.

The identification of the beneficial owner may be made by a responsible declaration of the client or the person who has been assigned the representation of the legal person. However, in operations whose risk is higher than average, the identification of the beneficial owner must be proven through additional documentation or through information obtained from reliable sources. Likewise, additional documentation must be requested in those cases in which it is considered that the information provided by the company is not truthful.

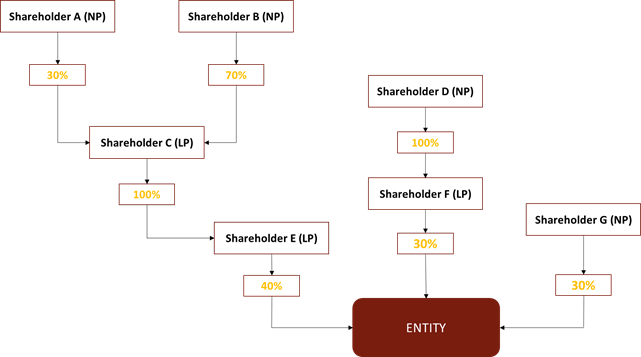

The Law offers a series of rules to determine who is considered the beneficial owner of the company. Specifically, they can be:

- The natural person or persons who ultimately own or control, directly or indirectly, a percentage greater than 25 percent of the capital or voting rights of a legal person.

In this case:

- Partner G is the direct beneficial owner by owning 30% of the company.

- Partner D is the indirect beneficial owner, since he is the only shareholder of partner F (who owns 30% of our client’s shares).

- Partner B is the beneficial owner by indirect control. On C’s board of directors, partner B has the majority, and therefore controls what happens in the 45% of our client.

- If there are no natural persons who own or control 25% of the capital, all administrators will be considered the beneficial owner. If any of the administrators was a legal person, the natural person acting on behalf of the legal person administrator will be considered the beneficial owner.

Remember: Obliged subjects should not maintain business relationships with companies whose beneficial owners have not been determined.

Real ownership of natural persons.

In cases of legal or voluntary representation of a natural person, the identity of the representative and the person represented must be verified through the reliable documents indicated above.

Likewise, a copy of the power of attorney conferred must be provided and, in cases of legal representation, the document that proves the representation (family book, sentence, etc.).

KNOWLEDGE OF THE CLIENT’S ACTIVITY

Prior to the establishment of the business relationship, the obliged subject must know the nature of the client’s professional or business activity as well as the origin of the funds with which they will deal with the operation. For this, the following documentation may be requested:

- Documents accrediting professional or business activity: working life, payroll, tax returns, annual accounts, etc.

- Accreditation of the origin of funds: tax returns, supporting documentation of the previous legal business, bank documentation, etc.

IMPORTANT:

To identify a natural person, I must request a valid identification document. For this, I will check which documents are valid in the regulations depending on the nationality and / or residence of the client. In the case of Spaniards, we will always request the ID (DNI in Spanish).

If a legal person refuses to identify its beneficial owners:

a) I can admit you as a client if it is possible to know through external sources who the real owners are.

b) I can start the operation if at the end I obtain the promise to obtain the supporting documentation before signing.

c) I can refrain from carrying out any operation if I cannot identify the beneficial owner because the law prohibits starting any type of business relationship with companies of which we do not know who their beneficial owners are.